A paper management initiative at TD shows how an environmental focus can advance cost-reduction and service-improvement goals

A key challenge for many organizations is balancing business goals with environmental responsibilities. But increasingly, companies are viewing the business-environment relationship as symbiotic, whereby environmental leadership goals align with and advance financial and customer-service objectives.

Take TD Bank Group. With a commitment to environmental leadership, TD strives to make the environment an integral part of how things get done at the bank. Its environmental leadership is well recognized. In 2014, for example, the bank was named one of the Global 100 Most Sustainable Corporations in the World and one of Canada’s Greenest Employers, and was the only Canadian financial institution to be included on The A List: The CDP Climate Performance Leadership Index 2014.

A key area of focus for the bank is paper reduction – customers told the bank that the number one thing it could do for the environment was use less paper. In today’s digital world, customers also expect more timely access to their banking information, simplified processes and quicker decisions – difficult expectations to meet in a paper-heavy environment.

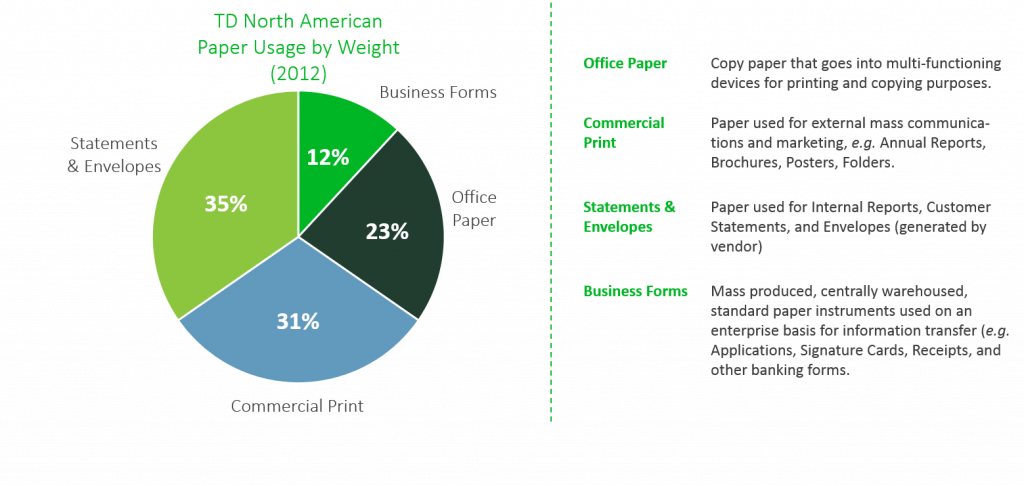

In 2010 – when TD used over 15,000 tonnes of paper – the bank made a commitment to reduce the volume of paper it used by 20% by 2015. Initially it focused on procurement; however this represents only about one-tenth of the total costs of paper management. It quickly became apparent that meaningful reduction and significant cost savings could only be achieved by gaining an in-depth understanding of paper-based business processes. However these processes are highly de-centralized, crossing many lines of business, which makes it difficult to quantify paper reduction and cost savings.

It became clear that in order to tackle paper reduction in a meaningful way, the bank needed to adopt a “total cost of ownership” approach to paper management that could be used to map all elements of the paper ‘lifecycle’ within the bank.

TD worked with OPTIMUS | SBR, a Canadian management consultant firm, to develop a Paper Management Estimation Tool (PMET) to assist with this. The tool recognizes the full end-to-end lifecycle of paper usage and allows project managers to quantify and monitor the full impact of their initiatives.

Understanding How Paper Management Impacts Business Processes

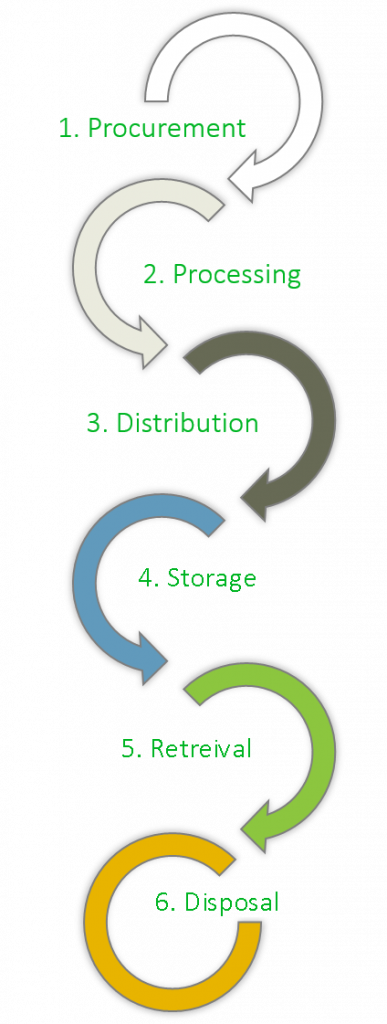

In large organizations, the cost of managing paper is widely dispersed across the enterprise, with different groups responsible for a portion of the end-to-end cost. This fragmented view of paper usage is the main hurdle to understanding the true cost of paper. The Paper Management Estimation Tool allows TD to better understand the full cost of paper across the enterprise by considering the six phases of paper management – i.e. the paper lifecycle.

- Procurement: The unit purchase cost of a single sheet of paper.

- Processing: The handling and processing of paper, including photocopying, scanning, faxing, and printing.

- Distribution: The delivery of paper from the bank or its partners to customers and vendors – also refers to the disbursement of paper among internal TD business units.

- Storage: The storage of processed and unprocessed paper either within TD or at a third-party vendor.

- Retrieval: The retrieval of paper from either internal filing space or a vendor.

- Disposal: The elimination of paper by way of recycling or shredding.

By understanding the costs associated with each phase of the lifecycle, TD has been able to focus on the underlying drivers of paper costs and pinpoint specific reduction strategies that increase business process efficiency. The tool has created a standardized approach to quantifying the cost of paper and has allowed project managers to identify savings that would not be considered in a standard business case.

Elements of the Paper Management Estimation Tool

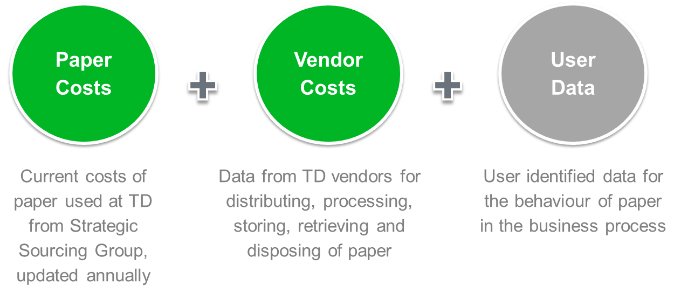

The estimation tool determines the end-to-end cost of paper at TD using a series of user-driven inputs and paper-related vendor data. The tool utilizes unit costs – drawn from TD’s Strategic Sourcing Group, its third-party suppliers and industry data – to estimate dollar costs for each type of paper and for all applicable phases of the paper lifecycle.

The tool users are required to answer a series of questions related to the paper lifecycle phases as part of their business case development process, including the amount of paper used, percentage of paper mailed externally, average size of files stored, etc.

The tool balances the need for a comprehensive assessment of all paper-related costs with the “ease-of-use” required to ensure it can be utilized by all 800 project managers across the bank. With unit cost information being updated on an annual basis, and transparent customizable assumptions, project managers are able to quickly update specific information throughout project phases to continually refine the business case supporting the initiative.

Benefits of using the Tool

Based on the specific project inputs and the unit cost information built into the tool, TD project leaders are able to understand the impact of their initiative on paper usage and potential cost reductions. They are able to evaluate each phase of the paper lifecycle to determine the best approach to save resources for the business and environment.

Paper Management Estimation Tool Sample Output

Now in use across the bank, the Paper Management Estimation Tool provides TD with a clear understanding of paper usage and costs across its business processes, allowing decision makers to focus on initiatives with the biggest impact to business and environmental objectives.

Added potential benefits of the tool include the ability to aggregate project initiatives across lines of business that involve similar business processes (e.g. digitization projects) and to share knowledge. The ability to review costs by lifecycle phase also makes it possible to focus on driving costs down across the bank through more efficient vendor management.

Optimus SBR Celebrates 6 Consecutive Wins as 2024 Best Workplaces™ in Professional Services

Our commitment to a people-first approach has been central to being recognized in 2024 for the sixth time as one of the Best Workplaces™ in Professional Services and the key to our overall success.

12 Best Practices to Increase Cross-Team Collaboration and Enhance Organizational Alignment

Enhancing cross-team collaboration drives innovation, optimizes resources, improves overall performance, and ensures every part of your organization works toward the same goals.

Enhancing Your Data Strategy for Success: The Power of Metadata

Metadata goes beyond just aiding in data retrieval. It ensures your data is secure, compliant and, most importantly, understood consistently by everyone in the organization.

Optimizing Language Translation Strategies: Beyond Compliance to Enhanced Operational Efficiency

The introduction of Quebec’s Bill 96 in Canada underscores the necessity for comprehensive translation strategies. Integrating machine translation technologies helps meet regulatory requirements while enhancing translation speed, cost efficiency, and operational effectiveness.

How to Manage Gen Z: 16 Strategies to Engage and Retain Young Talent

These practical strategies lead to a workplace that is better aligned with the values and expectations of Gen Z employees, ensuring that your efforts to attract and retain Gen Z talent are both successful and sustainable.

How to Measure the Success of Learning and Development: 12 Important Metrics to Evaluate

Quantifying the success of L&D training programs can be challenging. Learn about selecting and measuring the right metrics to determine whether your training efforts are truly making an impact.