The insurance industry is in a period of transition due to the changes in consumer expectations, exposure to climate, health, and economic events, regulatory pressures, and shifting market conditions.

A growing number of companies have seen significant returns when combining transformation objectives with pressing business priorities, such as the regulatory adoption of IFRS 17. Successful organizations are balancing their capabilities and capacity to take a measured approach to transformation by applying strategic elements of digitalization, automation, and prediction to the transformation agenda. Armed with the right tools and information, the office of the CFO and the finance function will continue to play a pivotal role in shaping the future of the insurance landscape.

Following the LDTI explanatory series, this article provides best practices in launching a successful financial transformation program that harnesses digitization, automation, and prediction through platforms, such as Vena and Microsoft Azure, and how to achieve financial transformation through a measured approach.

Understanding the Current State

The insurance industry is a challenging environment within which planning and forecasting become tricky due to the complexity and the many different processes involved in an organization amid rapidly shifting market conditions.

Today’s customers are savvier and more technology-literate than in the past. They are accustomed to using multiple channels to engage with a company and expect digital and accessible solutions across the board.

On the other hand, the frequency and severity of natural catastrophes have increased lately leading to evolving regulatory requirements that businesses need to promptly navigate and comply with, such as the recent global pandemic.

All this coupled with the typical planning technology challenges that face insurers makes for a tough planning environment, but not an impossible one to overcome. With a solid understanding of the current state, the available solutions, your business needs, and the way to strategize for better efficiency optimization, it becomes feasible to comply and thrive through the entire LDTI transformative implementation.

Financial Planning Technology is Key

The value in enabling financial planning technology is the automation and integration gained through the implementation. Taking the manual steps out of your process speeds it up by making it more efficient and removes the need to perform time-consuming validations.

Having a balance of pre-built industry-specific models with the ability to augment with bespoke models expedites time to value by allowing you to focus on what makes your organization unique.

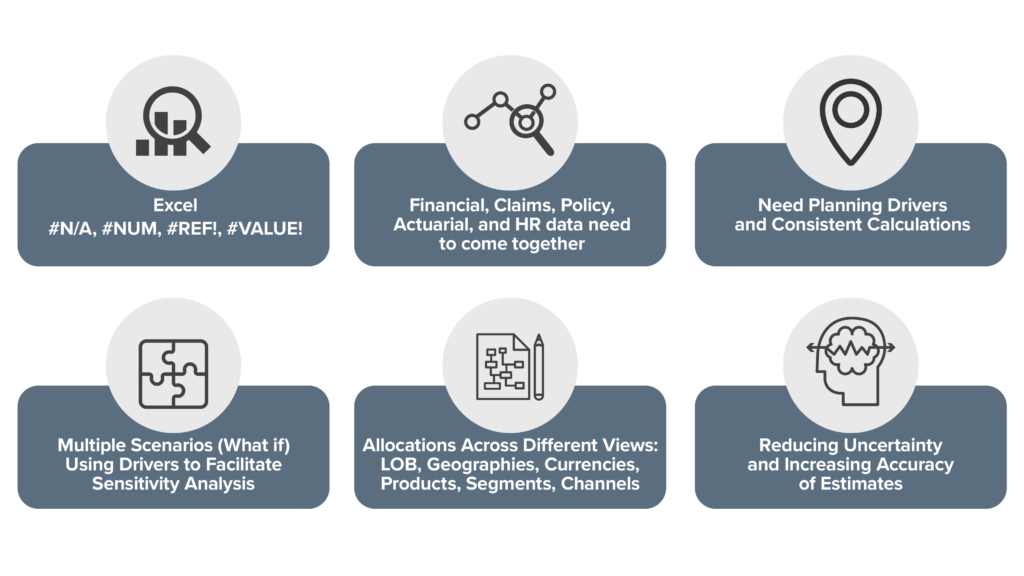

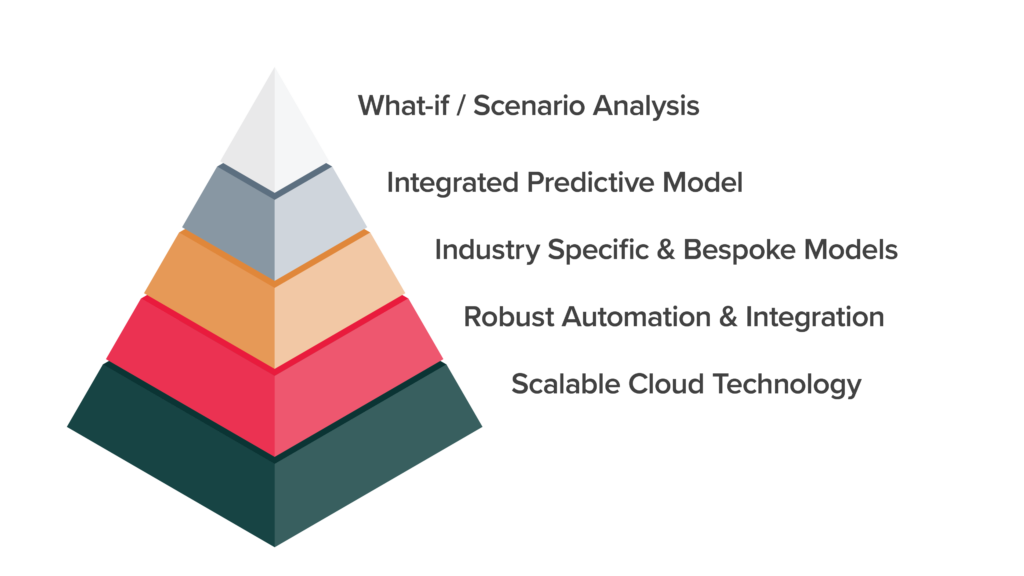

When selecting the best-fit planning technology for your organization, the following capabilities, illustrated in the graph below, should be considered:

Considering the capabilities of the aspired planning technology that suit your business needs, a scalable cloud technology shapes the foundational base of the funnel, and most financial planning technologies have already migrated to the Cloud. Yet, it should be noted that the ones born in the Cloud are the most scalable and optimized for this kind of deployment. Those who have migrated on-premises technologies to cloud often need a few generations before they get it right.

Also, when considering your financial planning technology, predictive planning should matter as it supports the continual evolution of your strategy. It leverages machine learning to take full advantage of internal/external datasets for richer business insights.

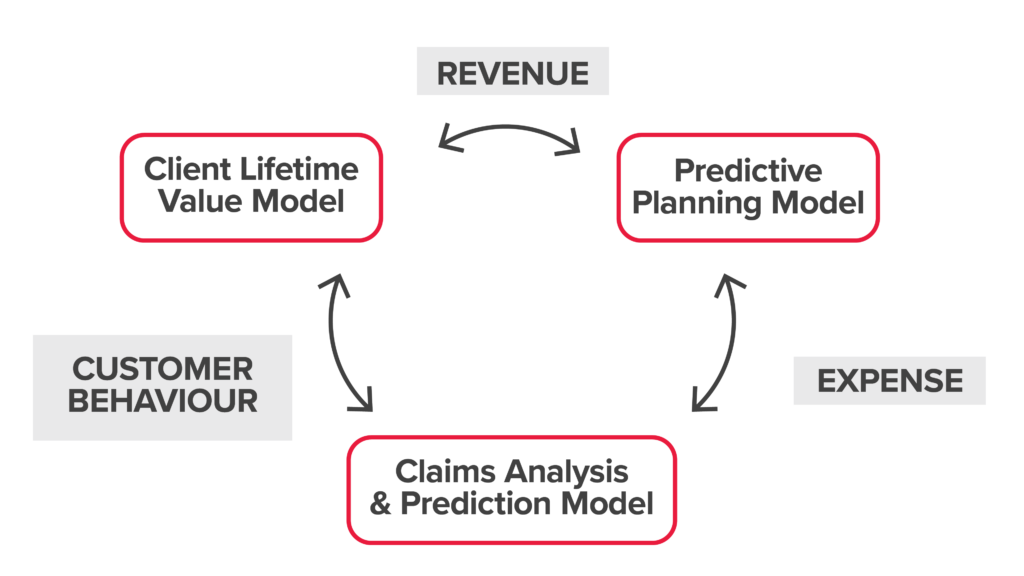

The predictive planning process works best when a balance of revenue and expense models are leveraged to tie the overall forecasting model together for your organization.

The predictive planning process can help answer key questions on the minds of insurers including:

- Project net premiums written for each insurance product.

- Project loss claims by loss level.

- Understand projected plan member increases and decreases.

- Understand required staffing levels and expense levels.

- Identify market and growth opportunities.

A Proven Recommendation

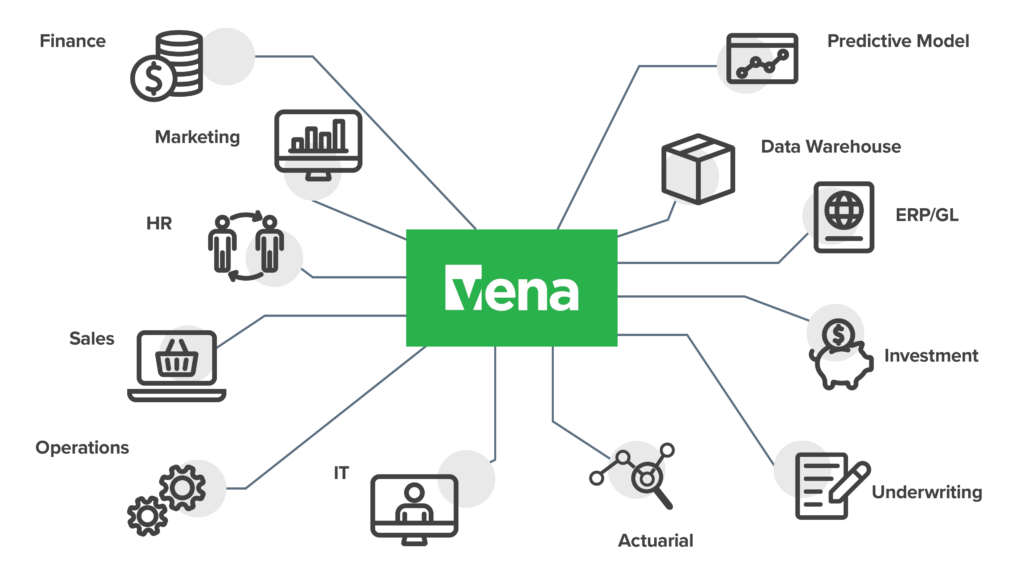

When navigating the financial planning technology space, Vena is by far the leader in its offering. The Vena platform uniquely combines the data collection and management capabilities of the cloud with the user experience comfort and familiarity of those accustomed to using Excel.

In addition, Vena provides a model specific for the insurance community as a baseline starting point for the accelerated implementation of the platform. It has a proven track record in connecting the dots for insurers while enabling the flexibility the office of finance needs to move the organization forward.

Helping You Optimize

In working with a number of insurers to advance their planning processes, we have established a predictive planning accelerator on the Vena and Microsoft Azure platforms that accelerates the path to LDTI compliance while advancing an insurer’s planning capability.

We would be pleased to showcase a demo of the predictive planning accelerator and how it can support the LDTI journey.

Optimus SBR’s Financial Services Practice

Optimus SBR is an independently owned management consulting firm that works with organizations across North America to get done what isn’t. Our Financial Services Group provides strategic advisory services, process improvement services, risk management services, and project management support to leading Financial Institutions, insurers, asset managers, and pension funds.

Contact us for more information on LDTI

Peter Snelling, Senior Vice President, Business Development

Peter.Snelling@optimussbr.com

416.649.9128

This piece was developed in partnership with BDO and Valani Global.

Optimus SBR, BDO, and Valani have come together to establish accelerators for the LDTI journey. Our accelerators do not only meet the compliance needs of LDTI, but also advance an insurer forward in the areas of financial transformation, operations modernization, and data innovation.

Service Partners |

|

|

|

|

|

With access to a global knowledge base and professional expertise, BDO offers extensive value to their clients across all segments of the insurance and financial services industry. |

|

|

|

|

|

|

|

Valani Global supports life insurance companies in achieving their financial risk management goals through implementations of Moody’s Analytics solutions including AXIS and RiskIntegrity for IFRS 17. |

Optimus SBR Celebrates 6 Consecutive Wins as 2024 Best Workplaces™ in Professional Services

Our commitment to a people-first approach has been central to being recognized in 2024 for the sixth time as one of the Best Workplaces™ in Professional Services and the key to our overall success.

12 Best Practices to Increase Cross-Team Collaboration and Enhance Organizational Alignment

Enhancing cross-team collaboration drives innovation, optimizes resources, improves overall performance, and ensures every part of your organization works toward the same goals.

Enhancing Your Data Strategy for Success: The Power of Metadata

Metadata goes beyond just aiding in data retrieval. It ensures your data is secure, compliant and, most importantly, understood consistently by everyone in the organization.

Optimizing Language Translation Strategies: Beyond Compliance to Enhanced Operational Efficiency

The introduction of Quebec’s Bill 96 in Canada underscores the necessity for comprehensive translation strategies. Integrating machine translation technologies helps meet regulatory requirements while enhancing translation speed, cost efficiency, and operational effectiveness.

How to Manage Gen Z: 16 Strategies to Engage and Retain Young Talent

These practical strategies lead to a workplace that is better aligned with the values and expectations of Gen Z employees, ensuring that your efforts to attract and retain Gen Z talent are both successful and sustainable.

How to Measure the Success of Learning and Development: 12 Important Metrics to Evaluate

Quantifying the success of L&D training programs can be challenging. Learn about selecting and measuring the right metrics to determine whether your training efforts are truly making an impact.