Long Duration Targeted Improvement, or LDTI, is the most significant change in decades to the existing accounting requirements under U.S. Generally Accepted Accounting Principles (USGAAP) for long duration contracts that are non-cancellable or guaranteed renewable contracts such as life insurance, disability income, long-term care, and annuities.

The ultimate objectives of this accounting standard change are:

- To provide a standardized framework allowing for a better comparison of risk across insurers;

- To improve the financial reporting of long-duration insurance contracts through improved information regarding the amount, timing, and uncertainty of cash flows, and

- To aid investors with improved information and disclosures which help to better understand the financial performance and risk of an insurance company.

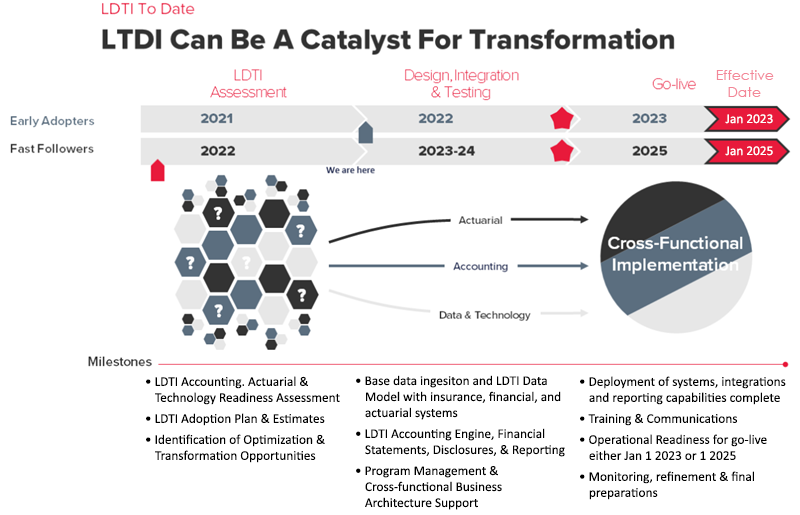

There are two groups of LDTI adopters. The complexities of LDTI apply to both:

- Early Adopters – These are SEC filers, excluding smaller reporting companies as defined by the SEC, for whom LDTI would be effective for fiscal years beginning after December 15, 2022 and for interim periods within those fiscal years.

- Fast Followers – All other entities for whom LDTI would be effective for fiscal years beginning after December 15, 2024 and for interim periods within fiscal years beginning after December 15, 2025. These non-SEC insurers who have a later implementation date and more time to implement will want to be fast followers.

Smaller insurers may believe that they might have a simpler path to compliance; however, they should not underestimate the complexity of the integration LDTI requires between actuarial, accounting, and IT teams, which will require ongoing detailed tracking that will be extremely difficult to do manually.

Smaller insurers may believe that they might have a simpler path to compliance; however, they should not underestimate the complexity of the integration LDTI requires between actuarial, accounting, and IT teams, which will require ongoing detailed tracking that will be extremely difficult to do manually.

Insurance industry -impact and implications

This disruption will transform the insurance industry regardless of the type of insurance underwritten. Business functions— from accounting to actuarial—will have to adjust.

Accounting – Accounting for LDTI is not as simple as just adjusting the accounting that currently takes place under current USGAAP. The grouping required for reserve calculations, ongoing tracking and creation, and eventual disaggregated roll-forwards mean the entire end-to-end process requires more details and continuity. Many insurers will look to track these details through in the form of additional dimensions and attributes to track directly within their general ledger to more easily tie together their financial statements and disclosures. Mapping those to the data requirements for the new standard is the baseline minimum change.

Data – Data is at the heart of LDTI. Ensuring comprehensive data quality, data controls, and data governance are all at the heart of a functioning LDTI compliance program. Data drives the LDTI accounting engine, is required for traceability and auditing of the results, and will need to flow in a connected manner across your core insurance, actuarial, and financial systems.

Reporting – Minimum compliance reporting requirements under LDTI are well beyond what is required under USGAAP. Generated data from your LDTI accounting engine will feed the minimum reporting requirements. Limiting investment to minimum viable product may be suitable in the short term, but capitalizing on the rich data sets from LDTI can transform an insurer’s business by providing deep customer and business insights to drive market penetration, retention, and profitability. In the end, the ongoing maintenance of data required for LDTI necessitates automation, as any manual maintenance will continue to become more onerous as your company continues to add new cohorts of business.

IT Systems – Compliance cannot be achieved without substantial alignment of supporting IT systems to match new accounting policies, data accessibility, and data analytics/reporting requirements. For many insurers, this is the time to question the investment in upgrading legacy point-to-point systems using LDTI as the mandate to upgrade to a data hub that captures all components of the requirement—allowing for alignment of the data flows for the end-to-end process.

Actuarial – In many cases, actuarial models will need to be upgraded to be LDTI compliant, adding new components and inputs, as well as providing updated outputs of your best estimated cash flows, containing new components such as risk adjustment. Alignment between actuals and expected at a granular level is something that LDTI will rely on in order for your LDTI accounting engine to work properly.

Insurance Companies and Investors – Impact and Implications

Consequences to the changes and volatility introduced from moving to GAAP to LDTI will affect investors and insurance companies.

Investors – Investors will need to recalibrate expectations for the financial position, profitability, and income volatility of insurance companies following the change in accounting standard from GAAP.

Insurance Companies – Insurance companies should also assess the strategic implications of LDTI to their business in order to develop a plan to address the required changes in processes under a narrowing timeline.

Bottom Line for Insurers

Insurers can use this change as an opportunity for investment into modernizing finance processes to better understand key drivers of change affecting financial statements.

In addition, insurers may want to engage in strategic divestitures of underperforming business that is not central to their strategy or consolidate a leading position in certain lines of business central to strategy to strengthen their positions.

With the runway to compliance shortening, insurers need to be rapidly examining and acting on their compliance plans. The only question left for most insurers is whether they use the opportunity of LDTI compliance to simply create a minimum viable product or to truly transform their business into the 21st century and take a market leadership position.

Optimus SBR’s Financial Services Practice

Optimus SBR is an independently owned management consulting firm that works with organizations across North America to get done what isn’t. Our Financial Services Group provides strategic advisory services, process improvement services, risk management services, and project management support to leading Financial Institutions, insurers, asset managers, and pension funds.

Contact us for more information on LDTI

Peter Snelling, Senior Vice President, Business Development

Peter.Snelling@optimussbr.com

416.649.9128

This piece was developed in partnership with BDO and Valani Global.

Optimus SBR, BDO, and Valani have come together to establish accelerators for the LDTI journey. Our accelerators do not only meet the compliance needs of LDTI, but also advance an insurer forward in the areas of financial transformation, operations modernization, and data innovation.

Service Partners |

|

|

|

|

|

With access to a global knowledge base and professional expertise, BDO offers extensive value to their clients across all segments of the insurance and financial services industry.

|

|

Valani Global supports life insurance companies in achieving their financial risk management goals through implementations of Moody’s Analytics solutions including AXIS and RiskIntegrity for IFRS 17. |

Optimus SBR Celebrates 6 Consecutive Wins as 2024 Best Workplaces™ in Professional Services

Our commitment to a people-first approach has been central to being recognized in 2024 for the sixth time as one of the Best Workplaces™ in Professional Services and the key to our overall success.

12 Best Practices to Increase Cross-Team Collaboration and Enhance Organizational Alignment

Enhancing cross-team collaboration drives innovation, optimizes resources, improves overall performance, and ensures every part of your organization works toward the same goals.

Enhancing Your Data Strategy for Success: The Power of Metadata

Metadata goes beyond just aiding in data retrieval. It ensures your data is secure, compliant and, most importantly, understood consistently by everyone in the organization.

Optimizing Language Translation Strategies: Beyond Compliance to Enhanced Operational Efficiency

The introduction of Quebec’s Bill 96 in Canada underscores the necessity for comprehensive translation strategies. Integrating machine translation technologies helps meet regulatory requirements while enhancing translation speed, cost efficiency, and operational effectiveness.

How to Manage Gen Z: 16 Strategies to Engage and Retain Young Talent

These practical strategies lead to a workplace that is better aligned with the values and expectations of Gen Z employees, ensuring that your efforts to attract and retain Gen Z talent are both successful and sustainable.

How to Measure the Success of Learning and Development: 12 Important Metrics to Evaluate

Quantifying the success of L&D training programs can be challenging. Learn about selecting and measuring the right metrics to determine whether your training efforts are truly making an impact.