The statutory requirements of IFRS 17 are forcing a massive disruption and ultimately a transformation within the insurance industry. No IFRS compliant insurer will be able to escape the profound changes in their operating model, accounting policies, and subsequent accounting system outputs and flows. This extends to connectivity and alignment with and actuarial systems and outputs—all underpinned by IT systems construct, data and reporting requirements.

Compliance can’t be achieved without substantial alignment of supporting IT systems to match new accounting policies, data accessibility and data analytics/reporting requirements. For many insurers, this is the time to question the investment in upgrading legacy point-to-point systems using IFRS 17 as the catalyst to upgrade to a data hub that captures all components of the requirement—allowing for alignment of the data flows for the end-to-end process.

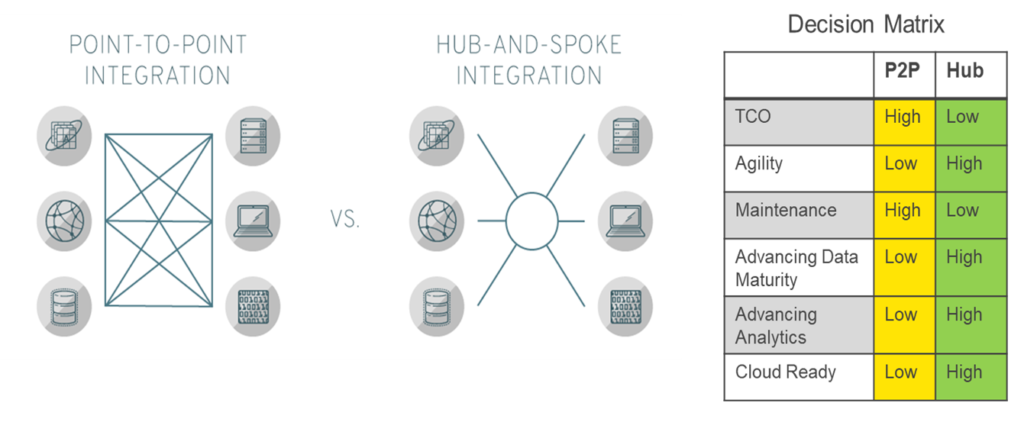

Here are a few of the key implementation realities that insurers are faced with as they look to decide on upgrading their point-to-point system or upgrade to a new data hub environment:

- The complexity of data integration for most IFRS 17 implementations is high given the significant footprint of policy, claims, financial, investments, and reinsurance data usually residing in a variety of source systems.

- The approach to data integration is a key consideration for the IT department because of its broader impact across the technology and data landscape. Those who combine the integration needs of IFRS 17 with the integration needs of other business objectives are able to achieve economies of scale in doing them together, leveraging the same integration strategy and platform.

- IFRS 17 presents a catalyst opportunity for IT to move away from a legacy point-to-point approach and adopt a modern hub approach. This facilitates the data connectivity for IFRS 17 and sets the foundation for data maturity advancement, enabling advance analytics outcomes that leverage the potential of artificial intelligence.

- When looking at the total cost of ownership, agility, maintainability, advancing data maturity, advancing analytics, and being cloud ready, there’s a clear advantage for a data hub strategy versus a point-to-point strategy.

- Given the rich dataset required for IFRS 17, it’s a great opportunity to take a look at your enterprise integration strategy and progressively modernize it through the IFRS 17 initiative.

While many insurers may challenge the cost/benefit of transitioning to newer data hub environments as they seek to comply with the new standard, our experience is that building on a point-to-point strategy is or more expensive that implementing a new data hub platform. Such upgrades also do not easily position the insurer to advance their overall data maturity/governance and to set the stage for capitalizing on the potential of advanced analytics.

With the compliance deadline fast approaching, insurers need to be rapidly examining and acting on their compliance plans.

We have established a data hub accelerator known as Insurhub based on the Microsoft Azure platform that accelerates the path to IFRS 17 compliance and advances an insurers data maturity for advanced analytics. The Insurhub accelerator shortens the timeline of IFRS 17 implementations with a library of data connectors, a data lake repository aligned with the requirements of IFRS 17, key financial statements and management reports, and collection of advanced analytics models.

Contact us to learn how a data hub strategy can accelerate your IFRS 17 journey and advance the data maturity needs of your organization.

(This is the third in a series of seven articles. Future articles will do a deep dive on each of the five key action areas)

Optimus SBR’s Financial Services Practice

Optimus SBR is an independently owned management consulting firm that works with organizations across North America and the Caribbean to get done what isn’t. Our Financial Services Group provides strategic advisory services, process improvement services, risk management services, and project management support to leading Financial Institutions, insurers, asset managers, and pension funds.

Contact us for information on our IFRS 17 Jumpstart Acceleration Program:

Peter Snelling, Senior Vice President, Business Development

Peter.Snelling@optimussbr.com

416.649.9128

Evan Farlinger, Principal, Financial Services Group

evan.farlinger@optimussbr.com

647.502.3739

Service Partners |

|

|

|

|

|

With access to a global knowledge base and professional expertise, BDO offers extensive value to their clients across all segments of the insurance and financial services industry. |

|

|

|

|

KR Services specializes in the practical application of international financial reporting and actuarial standards in the developing world. |

|

|

|

|

Valani Global supports life insurance companies in achieving their financial risk management goals through implementations of Moody’s Analytics solutions including AXIS and RiskIntegrity for IFRS 17. |

Optimus SBR Celebrates 6 Consecutive Wins as 2024 Best Workplaces™ in Professional Services

Our commitment to a people-first approach has been central to being recognized in 2024 for the sixth time as one of the Best Workplaces™ in Professional Services and the key to our overall success.

12 Best Practices to Increase Cross-Team Collaboration and Enhance Organizational Alignment

Enhancing cross-team collaboration drives innovation, optimizes resources, improves overall performance, and ensures every part of your organization works toward the same goals.

Enhancing Your Data Strategy for Success: The Power of Metadata

Metadata goes beyond just aiding in data retrieval. It ensures your data is secure, compliant and, most importantly, understood consistently by everyone in the organization.

Optimizing Language Translation Strategies: Beyond Compliance to Enhanced Operational Efficiency

The introduction of Quebec’s Bill 96 in Canada underscores the necessity for comprehensive translation strategies. Integrating machine translation technologies helps meet regulatory requirements while enhancing translation speed, cost efficiency, and operational effectiveness.

How to Manage Gen Z: 16 Strategies to Engage and Retain Young Talent

These practical strategies lead to a workplace that is better aligned with the values and expectations of Gen Z employees, ensuring that your efforts to attract and retain Gen Z talent are both successful and sustainable.

How to Measure the Success of Learning and Development: 12 Important Metrics to Evaluate

Quantifying the success of L&D training programs can be challenging. Learn about selecting and measuring the right metrics to determine whether your training efforts are truly making an impact.