The statutory requirements of IFRS 17 are forcing a massive disruption and ultimately a transformation within the insurance industry. No IFRS compliant insurer will be able to escape the profound changes in their operating model, accounting policies, and subsequent accounting system outputs and flows. This extends to connectivity and alignment with and actuarial systems and outputs—all underpinned by IT systems construct, data and reporting requirements.

By now, most insurers have established an IFRS 17 implementation plan and are working on the design of their solution. This article outlines how the right data strategy for IFRS 17 can be extended across the enterprise to advance an insurer’s data maturity rapidly and cost effectively leveraging the investments in IFRS 17 as a foundation.

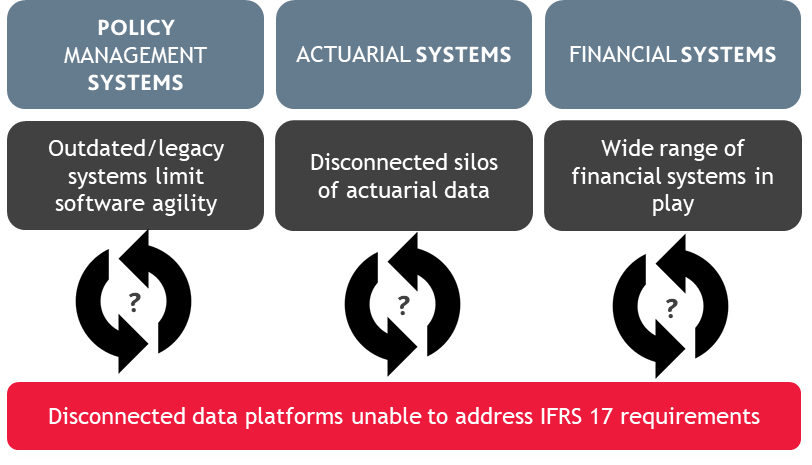

In working with many IT leaders on IFRS 17, we recognize that adoption of the new standard poses many issues for insurers, including:

In working with many IT leaders on IFRS 17, we recognize that adoption of the new standard poses many issues for insurers, including:

- Significant data connectivity asks are being made to fulfill the requirements of IFRS 17.

- Quick decisions on cloud may be required as many IFRS 17 accounting engines are only available in a cloud model.

- A complex mix of current and legacy infrastructure present challenges for IT teams.

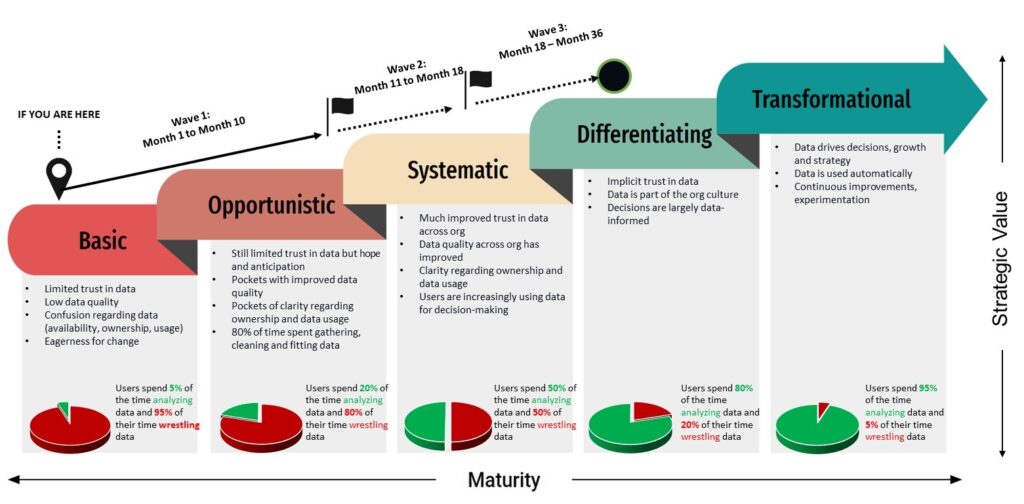

- Considerable differences between insurers in terms of where they are on the data maturity spectrum.

Despite these challenges, the data advancements required for IFRS 17 are often the right advancements to apply to the overall enterprise. This includes the following benefits.

Data as an asset

- The value of the data for most IFRS 17 implementations is high given the significant footprint of policy, claims, financial, investments, and reinsurance data residing in a variety of source systems. Establishing the right single source of the truth for the IFRS 17 dataset can naturally become the right single source of the truth for the enterprise.

Agile data integration

- IFRS 17 often requires a significant investment in data integration because of the broad impact across the technology and data landscape. Those who combine the integration needs of IFRS 17 with the integration needs of other business objectives are able to achieve economies of scale by leveraging the same integration strategy and platform.

- IFRS 17 presents a catalyst opportunity for IT to move away from a legacy point-to-point approach and adopt a modern hub approach. This enables not only the data connectivity for IFRS 17, but also sets the foundation for data maturity advancement and advanced analytics outcomes by leveraging the potential of AI.

Business intelligence and advanced analytics maturity

- Given the rich dataset required for IFRS 17 and the financial and management reporting requirements, it’s a great opportunity to leverage the business intelligence and advanced analytics used for IFRS 17 for the enterprise.

Data governance and literacy maturity

- The pragmatic data governance and data operations strategy required for IFRS 17 can be applied as the gold standard for other high-value data sets across the organization.

- The data literacy and education approach for IFRS 17 is often the same approach for advancing an organization’s data literacy overall.

The opportunity

The deadline for IFRS 17 compliance is rapidly approaching, making it crucial for insurers to examine and act on their compliance plans sooner rather than later. The question for most insurers now is: will they simply create a minimum viable product or will they seize this opportunity to truly transform their business and take a market leadership position?

Our service partner BDO has established a data platform accelerator for the insurance industry known as InsurHub to meet the data needs of IFRS 17 and establish the foundation for enterprise data advancement. It leverages the Microsoft Azure data platform and contains fundamental best practices to be the gold standard for pragmatic data governance and operations.

Why InsurHub?

Why InsurHub?

InsurHub can help accelerate the path to IFRS 17 compliance and establish the foundation for enterprise data advancement. The InsurHub accelerator shortens the timeline of IFRS 17 implementations with a library of data connectors, a data lake repository aligned with the requirements of IFRS 17, key financial statements and management reports, and a collection of advanced analytics models. It contains fundamental best practices to be the gold standard for pragmatic data governance and operations.

Don’t let this opportunity for enterprise data advancement pass by. Our team can help you build a data hub strategy that accelerates your IFRS 17 journey and advances the data maturity needs of your organization. Contact us to get started.

(This is the fifth in a series of seven articles.)

Optimus SBR’s Financial Services Practice

Optimus SBR is an independently owned management consulting firm that works with organizations across North America and the Caribbean to get done what isn’t. Our Financial Services Group provides strategic advisory services, process improvement services, risk management services, and project management support to leading Financial Institutions, insurers, asset managers, and pension funds.

Contact us for information on our IFRS 17 Jumpstart Acceleration Program:

Peter Snelling, Senior Vice President, Business Development

Peter.Snelling@optimussbr.com

416.649.9128

Evan Farlinger, Principal, Financial Services Group

evan.farlinger@optimussbr.com

647.502.3739

Service Partners |

|

|

|

|

|

With access to a global knowledge base and professional expertise, BDO offers extensive value to their clients across all segments of the insurance and financial services industry. |

|

|

|

|

KR Services specializes in the practical application of international financial reporting and actuarial standards in the developing world. |

|

|

|

|

Valani Global supports life insurance companies in achieving their financial risk management goals through implementations of Moody’s Analytics solutions including AXIS and RiskIntegrity for IFRS 17. |

Optimus SBR Celebrates 6 Consecutive Wins as 2024 Best Workplaces™ in Professional Services

Our commitment to a people-first approach has been central to being recognized in 2024 for the sixth time as one of the Best Workplaces™ in Professional Services and the key to our overall success.

12 Best Practices to Increase Cross-Team Collaboration and Enhance Organizational Alignment

Enhancing cross-team collaboration drives innovation, optimizes resources, improves overall performance, and ensures every part of your organization works toward the same goals.

Enhancing Your Data Strategy for Success: The Power of Metadata

Metadata goes beyond just aiding in data retrieval. It ensures your data is secure, compliant and, most importantly, understood consistently by everyone in the organization.

Optimizing Language Translation Strategies: Beyond Compliance to Enhanced Operational Efficiency

The introduction of Quebec’s Bill 96 in Canada underscores the necessity for comprehensive translation strategies. Integrating machine translation technologies helps meet regulatory requirements while enhancing translation speed, cost efficiency, and operational effectiveness.

How to Manage Gen Z: 16 Strategies to Engage and Retain Young Talent

These practical strategies lead to a workplace that is better aligned with the values and expectations of Gen Z employees, ensuring that your efforts to attract and retain Gen Z talent are both successful and sustainable.

How to Measure the Success of Learning and Development: 12 Important Metrics to Evaluate

Quantifying the success of L&D training programs can be challenging. Learn about selecting and measuring the right metrics to determine whether your training efforts are truly making an impact.