Optimizing Language Translation Strategies: Beyond Compliance to Enhanced Operational Efficiency

The introduction of Quebec’s Bill 96 in Canada underscores the necessity for comprehensive translation strategies. Integrating machine translation technologies helps meet regulatory requirements while enhancing translation speed, cost efficiency, and operational effectiveness.

Unleashing the Potential of IFRS 17 Through Effective Process Documentation

To effectively implement IFRS 17, insurers must carefully assess their existing processes and determine how the new IFRS 17 processes can replace or integrate with them.

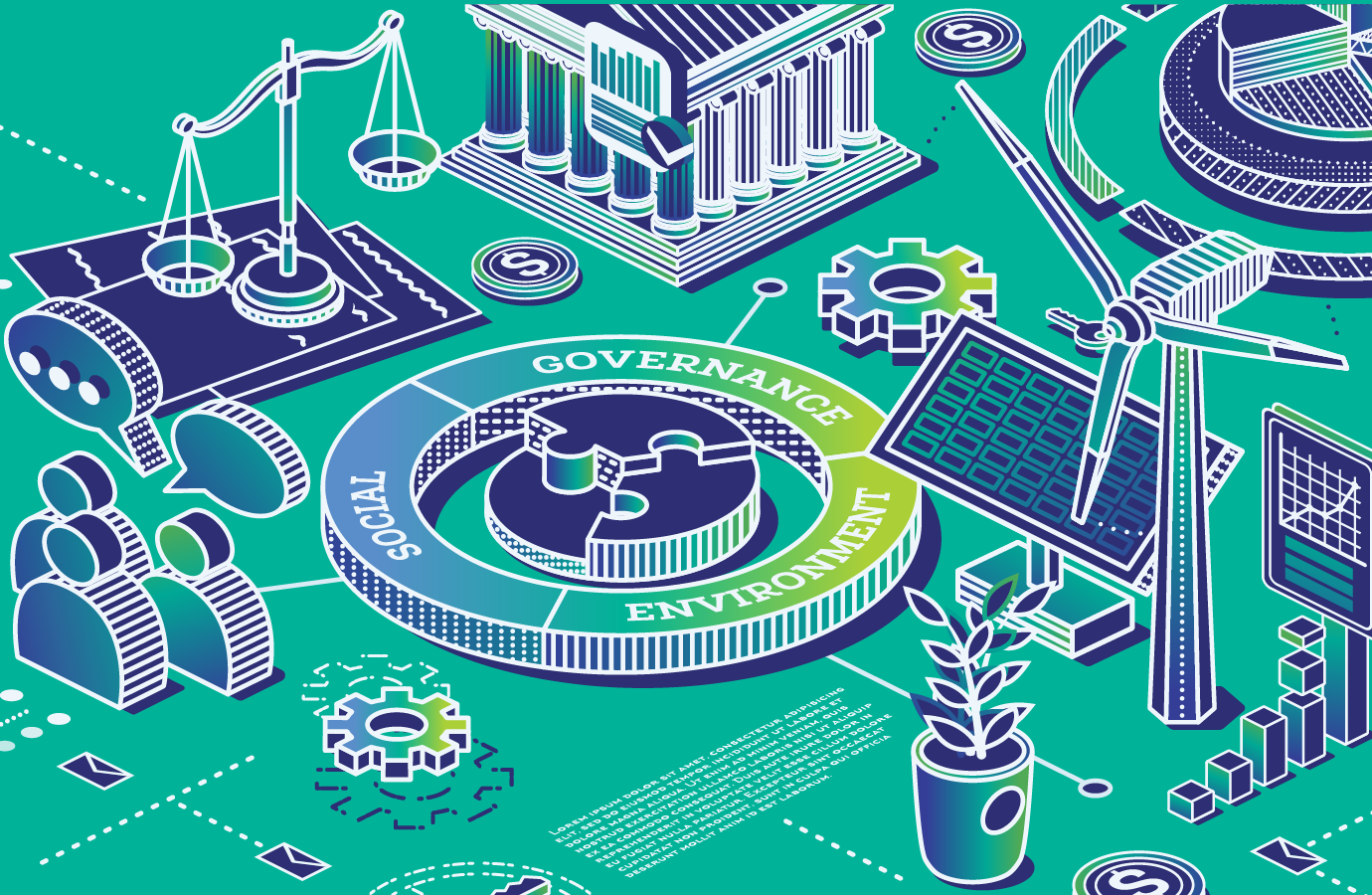

Navigating the Future: How Canadian Leaders Can Forge Resilient Strategies in the ESG Landscape

By adapting a proactive approach leaders can effectively navigate the complexities of the evolving ESG landscape and foster trust in an increasingly conscientious market.

Privacy Law 25: Five Essential Priorities to Drive Success for Canadian Financial Institutions in 2024

By prioritizing these six key areas and taking the necessary actions, organizations can build trust and confidence among consumers, while ensuring compliance with both current and future Canadian privacy regulations.

Automate and Digitize: Where Should Credit Unions Start to Build Efficiency?

Credit unions that want to improve efficiency should start by identifying their pain points, building a business case for digitization/automation, conducting a pilot program, implementing quick wins, and exploring new opportunities.

How Canadian Credit Unions Can Leverage ESG Principles and Technology to Reach a Younger Generation of Members

The incorporation of ESG principles by CCUs, coupled with the effective use of technology and targeted marketing, presents a powerful strategy for attracting younger members and securing future growth.

Mastering IFRS 17 with a Strategic Target Operating Model

When applied specifically to the realm of IFRS 17, a strategic Target Operating Model provides a high-level view of the end-to-end solution design, processes, controls, and close schedule required to execute the new finance model.

How to Capitalize on Your IFRS 17 Investment

With guidance and support insurers can move from IFRS 17 compliance to business as usual (BAU) and fully capitalize on their investment.

Steering Through Uncertainty: The Impact of IFRS 17 on Risk Management and Control Strategies

With a strong emphasis on accuracy and integrity, insurers are faced with the task of redefining their control environments and governance structures for financial reporting.

LDTI Article 7 – How the Right Governance Strategy Can Achieve More Than Just LDTI Compliance

In this seventh and final article of our LDTI series, we explain how a sound strategy allows for more than LDTI compliance and sets the stage for success beyond mere implementation.

LDTI Article 6 – A Catalyst for Finance Transformation

This article provides best practices in launching a successful financial transformation program that harnesses digitization, automation, and prediction through platforms, such as Vena and Microsoft Azure.

LDTI Article 5 – How LDTI Implementation Can Modernize Your Operations

This article explores modernized ways the LDTI implementation yields on the insurance landscape while stressing the importance of the human element in equipping the workforce of tomorrow.

LDTI Article 4 – Benefits and Challenges of Advancing Data Maturity

In this article, we outline the benefits and challenges of advancing data maturity and how to leverage the investments in LDTI as a foundation to address the data needs of the broader enterprise.

LDTI Article 3 – Top Business Impacts of LDTI

This article looks at how the changes in accounting policies affect actuarial measurements and what they look like before and after the implementation.

LDTI Article 2 – Get Ahead of Your Regulatory Requirements by Using the Power of a Data Fabric

For many insurers, this is the time to question the investment in upgrading legacy point-to-point systems, using LDTI as the reason to consider an upgrade to a data fabric that captures all components of the requirement.

LDTI – Accelerate Your Implementation with the Fast Follower Strategy

Long Duration Targeted Improvement (LDTI) is the most significant change in decades to the existing accounting requirements under U.S. Generally Accepted Accounting Principles (USGAAP) for long duration contracts that are non-cancellable or guaranteed renewable contracts.

IFRS 17 – The Race to the Finish – The Standard vs Implementation Realities

In this final article of our IFRS 17 series, we pull everything together and discuss the other large standard impact that is likely to occur.

IFRS 17 – The Race to the Finish – Actuarial Work and IFRS 17

IFRS projects produce their own actuarial challenges. We discuss what changes you likely face, and how to address them.

IFRS 17 – Race to the Finish – Technology Solution: The Right Strategy for Data

This article outlines how the right data strategy for IFRS 17 can be extended across the enterprise to advance an insurer’s data maturity rapidly and cost effectively leveraging the investments in IFRS 17 as a foundation.

IFRS 17 – Race to the Finish – Don’t Underestimate the Complexity, Even for P&C

Even the simplest, monoline property and casualty insurers have realized there are significant complexities in practice. We have detailed some of the items you need to consider on your IFRS 17 journey.

IFRS 17: The Race to the Finish – Technology Solution Point-to-Point vs. Data Hub

Here are a few of the key implementation realities that insurers are faced with as they look to decide on upgrading their point-to-point system or upgrade to a new data hub environment.

IFRS 17: The Race to the Finish – The Standard vs. Implementation Realities

We have detailed a few of the key implementation realities that insurers are faced with as they seek to comply with the new standard.

IFRS 17: The Race to the Finish – Disruption and Transformation at Your Doorstep

With time running out, the only question left for most insurers is whether they use the opportunity of IFRS 17 compliance to simply create a minimum viable product or to truly transform their business into the 21st century and take a market leadership position.

Product Optimization: Your Competitive Advantage in a Changing World

The goal of effective product management is to ensure that products remain relevant, competitive, and profitable in the current environment. Product Optimization takes product management to the next level.

Large Regulatory Change Implementations in Financial Institutions

Must-do projects like regulatory changes can seem overwhelming and daunting, but it doesn’t need to be. With some careful forethought and the right expertise, regulatory programs can extend beyond just staying onside with the regulator, and set your organization up for long-term success.

2019 Ontario Budget Briefing Note

This Briefing Note highlights key elements of interest to our clients from the 2019 Ontario Budget announcement.