How do you harness Non-Market factors? Anyone in Ontario taking advantage of the province’s “Feed-in Tariff” has an answer.

But while most people can name a host of Market Factors that shape business strategy, including saturation, maturity, fragmentation, etc., the mention of Non-Market Factors (regulation, public pressure, etc.) often draws blank stares.

Market Factor Strategies are built on maximizing offense-oriented business line priorities. Conversely, Non-Market Factor Strategies focus on minimizing negative impacts and liabilities. As a result, responses to Non-Market factors (led by governance, compliance and risk management functions among others) are all too often treated as boxes to be routinely checked off.

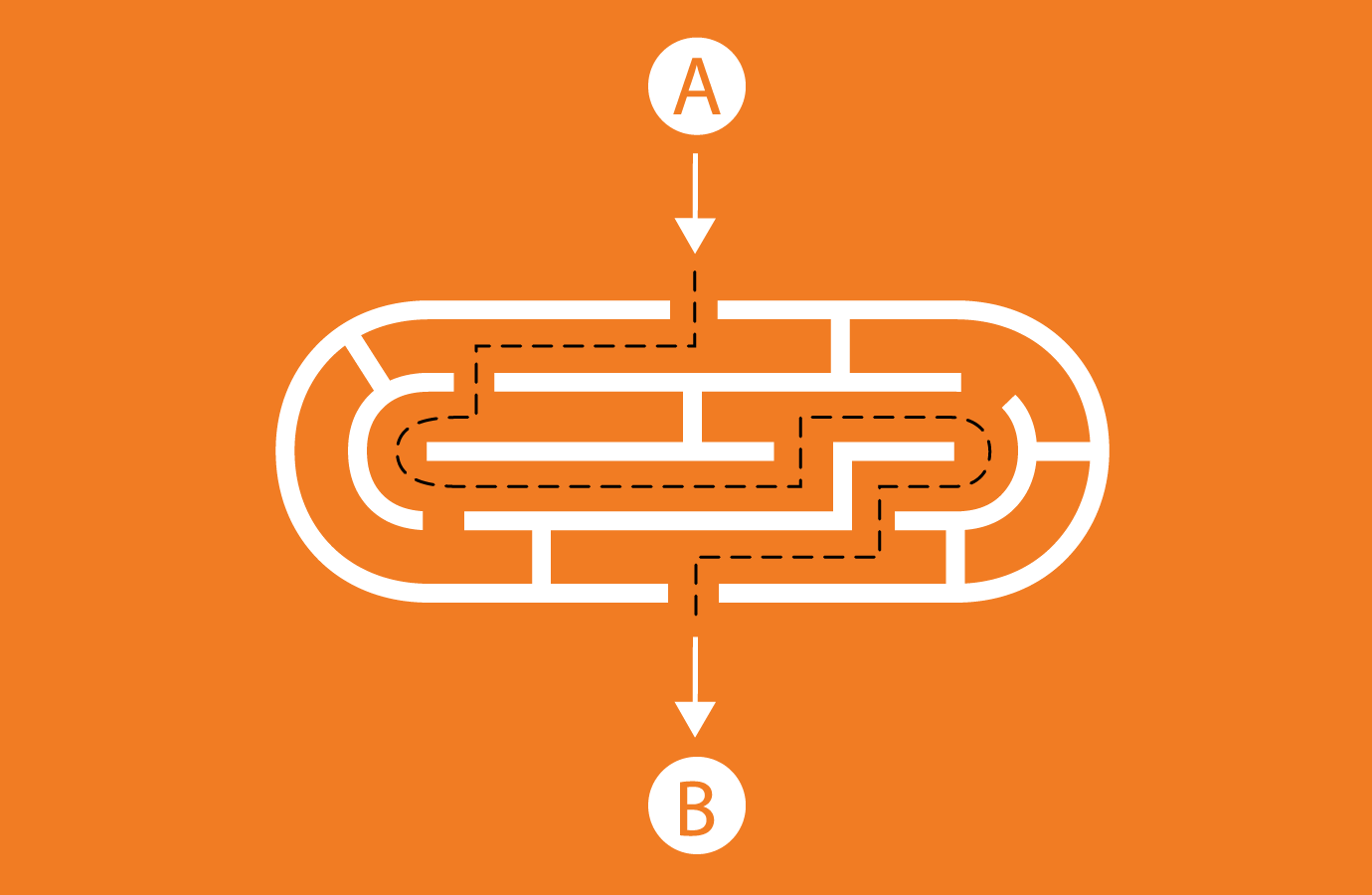

The checklist approach can be dangerous, as Non-Market factors can often be a source of Black Swan events. But a strategic plan that fails to integrate your organization’s approach to market and non-market factors also risks missing real opportunities.

Prof. Richard Rumelt of UCLA points out that every change or innovation uncovers (one might add, creates) new value denials. By value denials, Rumelt means missed opportunities. When it comes to Non-Market factors, these opportunities are frequently driven by institutions and constituencies that often treat regulatory and environmental directives as a cost that must be borne and often minimized.

However, some organizations are re-thinking Non-Market Factors as a way to capture opportunities. One way to do this is to rework your risk management plans. This often requires a strategic pivot by the whole organization. A key reason this strategic pivot is not made is that while every organization must manage risk, and many of those risks are on Non-Market fronts, most organizations do not treat risk management as a core line of business.

Three Strategic Planning Approaches that consider both Non-Market and Market Factors

Some of OPTIMUS | SBR’s most daring clients are seeking aggressive ways to retain risk, and harness the opportunities that go along with it. In so doing they are able to create new benefits to stakeholders and customers upstream.

The key to this emerging practice is to balance the capabilities you need to build to meet Non-Market factors such as compliance with ones that also enhance market competiveness. Three key approaches are emerging—

1. Turn Trash into Treasure: Some organizations are developing new, creative ways of finding value hidden in assets abandoned, underused or devalued because of their associated risk. A good example of this is the growing industry of recycling solution providers with ISO and Ministry of the Environment certification that assume others’ ‘risk’, process it and as a result are able to extract valuable material that can be repurposed.

2. Influence the Agenda: partnering with regulatory bodies that are tasked with regulatory oversight has two key benefits: First, you ensure optimal alignment between your organization’s offerings and activities to the regulator’s mandate to achieve social improvements. Second, you position yourself in the marketplace as an adoption leader, effectively minimizing any perceived pass-along risk to your clients. Corporations building corruption-busting partnerships in developing economic zones are an example.

3. Set the Benchmark: By cultivating your mandate and strategy work where stable benchmarks and comparator data do not exist, you could potentially prevent the need for Non-Market factors to be created. The more dynamic utilities and banks are finding ways to partner with their oversight stakeholders to shape the regulatory environment and pre-empt regulation by improving their self-assurance.

Complex and onerous regulatory obligations (think the new Basel III rules, or the EPA’s broadened regulatory efforts under the Clean Air Act) are heating the crucible, forcing —or enticing— both large and mid-size organizations to see factors such as regulatory and environmental risk the way public-sector entities do: as a top-tier success factor. Look for the trend to gather momentum, but in unpredictable ways.

Optimus SBR Celebrates 6 Consecutive Wins as 2024 Best Workplaces™ in Professional Services

Our commitment to a people-first approach has been central to being recognized in 2024 for the sixth time as one of the Best Workplaces™ in Professional Services and the key to our overall success.

12 Best Practices to Increase Cross-Team Collaboration and Enhance Organizational Alignment

Enhancing cross-team collaboration drives innovation, optimizes resources, improves overall performance, and ensures every part of your organization works toward the same goals.

Enhancing Your Data Strategy for Success: The Power of Metadata

Metadata goes beyond just aiding in data retrieval. It ensures your data is secure, compliant and, most importantly, understood consistently by everyone in the organization.

Optimizing Language Translation Strategies: Beyond Compliance to Enhanced Operational Efficiency

The introduction of Quebec’s Bill 96 in Canada underscores the necessity for comprehensive translation strategies. Integrating machine translation technologies helps meet regulatory requirements while enhancing translation speed, cost efficiency, and operational effectiveness.

How to Manage Gen Z: 16 Strategies to Engage and Retain Young Talent

These practical strategies lead to a workplace that is better aligned with the values and expectations of Gen Z employees, ensuring that your efforts to attract and retain Gen Z talent are both successful and sustainable.

How to Measure the Success of Learning and Development: 12 Important Metrics to Evaluate

Quantifying the success of L&D training programs can be challenging. Learn about selecting and measuring the right metrics to determine whether your training efforts are truly making an impact.