In our previous article, we highlighted the significance of insurers adapting their operating models to align with the changes brought about by IFRS 17. These changes impact finance, actuarial, and technology departments within insurance companies. Streamlining communication and collaboration between these functions is now more critical than ever for seamless operations and accurate financial reporting. In this article, we will explore the crucial first step of documenting new processes and how it sets the foundation for successful transformation.

To effectively implement IFRS 17, insurers must carefully assess their existing processes and determine how the new IFRS 17 processes can replace or integrate with them. The goal is to minimize disruptions while maximizing the benefits that come with the new standard.

Here’s where insurers need to concentrate their efforts:

- Highlighting New IFRS 17 Processes: Pinpointing the specific processes requiring attention and devising a change management plan is crucial for a smooth transition to IFRS 17.

- Enhancing Existing Finance Processes: It is imperative to assess non-IFRS 17 finance processes and determine if enhancements or integration are required to fully leverage the opportunities generated by the new systems and information provided through the IFRS 17 transition.

- Streamlining IFRS 4 Processes: Evaluating current IFRS 4 processes for decommissioning will simplify the overall Finance Target Operating Model, ensuring seamless operations and freeing up valuable resources.

But why is documenting these processes so crucial? Let’s explore the key benefits:

Knowledge Management

Proper documentation serves as a valuable training tool for new employees or those taking on new roles, enabling them to quickly grasp their responsibilities and ensure consistent adherence to established procedures. This consistency leads to better quality and more accurate outcomes.

Continuous Improvements

Documented processes help identify bottlenecks and inefficiencies, leading to streamlined workflows, reduced costs, and opportunities for automation. The ability to track and analyze performance metrics also facilitates targeted improvements, enhancing overall efficiency and accuracy.

Audit and Regulatory Compliance

Thorough documentation aids auditors in understanding the new IFRS 17 solution, enabling efficient audits and reducing costs for insurers.

By recognizing the benefits of documenting IFRS 17 processes, insurers can optimize their operations, increase efficiency, and ensure compliance with this new accounting standard.

The Essential Elements for Effective Documentation

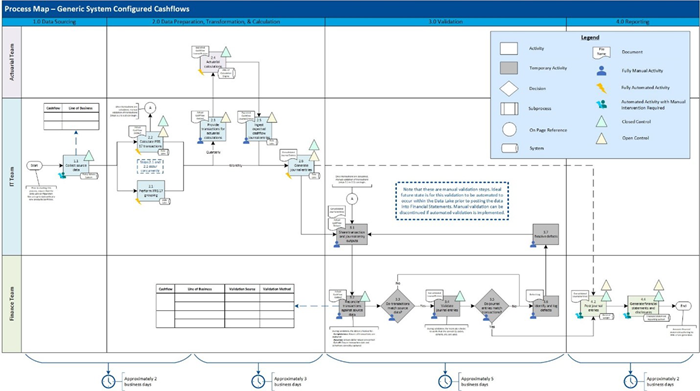

When it comes to documenting your processes, having a clear and comprehensive view is crucial. That’s why properly documented process maps are invaluable. These maps provide a detailed breakdown of the activities involved in your overall IFRS 17 solution architecture. From sourcing data to presenting it in financial statements and disclosures, every step is articulated.

So, what are the key elements that should be included in your process documentation? Here’s a rundown:

- Activities: Capture the steps required to execute and complete the process.

- Handoffs: Identify the transfers of process items or activities between teams, both within and outside your organization.

- Roles: Specify the individuals responsible for each task, including their job titles and roles.

- Systems: Highlight the systems, applications, technology tools, and job aids used to support and streamline the process.

- Control Points: Implement business controls to ensure accuracy, compliance, and data integrity.

- Processing Time: Track the overall duration of each phase of the process.

To better illustrate these elements, we have provided a sample process map that outlines the creation of IFRS 17 cashflows, from the policy admin system to financial statements.

Click diagram to enlarge.

A Final Thought

Once detailed end-to-end processes are documented, insurers can pinpoint areas that can be automated, identify bottlenecks, and find processes that take too long. Armed with this knowledge, targeted continuous improvement plans can be developed to streamline operations.

Taking a holistic view of end-to-end processes also helps businesses identify and address key risks. In our upcoming article, we will explore how to design and implement mitigating controls to effectively tackle these risks.

Effective documentation and continuous improvement efforts can help your organization streamline processes, boost efficiency, and ensure compliance with regulations. Take control of your operations and drive success with these strategies.

Optimus SBR’s IFRS 17 BAU Acceleration Services

Our IFRS 17 BAU Acceleration services help organizations fully leverage their IFRS 17 infrastructure to optimize their investment. Our team is one of the most experienced in the industry, having already supported 24 organizations, both in Canada and globally, through their implementation journey. We have the proven strategic and tactical expertise to help insurers get the most out of this new standard.

Contact Us for more information on how we can assist your team.

Evan Farlinger, CPA, CA – Principal, Financial Services Practice

Evan.Farlinger@optimussbr.com

Farshid Buhariwalla, CPA, CA – Principal, Financial Services Practice

Farshid.Buhariwalla@optimussbr.com

Industry Insights

Service Insights

Case Studies

Company News